News

Backdoor Roth IRAs

Posted on January 16, 2025

As we embark on a new year filled with opportunities, now is the time to revisit your retirement savings strategy. While we marvel at the fact that we’re now closer to 2050 than we are to 1999, it’s important to look back at your retirement account contributions from 2024. If you have not maxed out your contributions for last year, you still have until April 15, 2025, to make catch-up contributions.

High-income earners often face unique challenges when it comes to contributing to Roth IRAs due to income limits. However, a powerful solution exists: the backdoor Roth IRA.

But if you already have pre-tax IRA funds, a backdoor Roth conversion may result in a significant tax bill, reducing the effectiveness of the strategy. This is why it’s important to consult with your financial advisor to see if this tactic is right for your situation.

Why Consider a Backdoor Roth IRA?

Traditional IRAs and Roth IRAs are both valuable tools for retirement savings, but each has its own rules and benefits:

- Traditional IRA: Contributions may be tax-deductible, but withdrawals in retirement are taxed as ordinary income. Additionally, Required Minimum Distributions (RMDs) begin at age 73. [i]

- Roth IRA: Contributions are made with after-tax dollars, qualified withdrawals are tax-free, and there are no RMDs during the account owner’s lifetime.

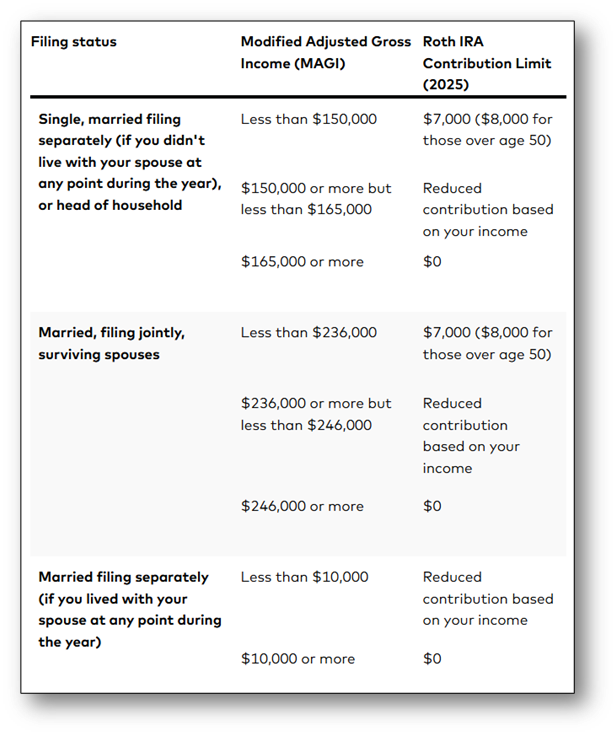

Unfortunately, Roth IRA contributions are phased out at higher income levels, leaving many high earners unable to benefit directly. While the Roth IRA contribution limits for 2025 are the same as 2024, the income limits have changed for 2025:

- Single filers: Must make less than $150,000 to contribute the full $7,000.

- Married couples filing jointly: Must make less than $236,000 to contribute the full $7,000.

- Phase-out range: For singles, the phase-out range is $79,000 to $89,000. For married couples filing jointly, the range is $126,000 to $146,000.

How Backdoor Roth IRAs Work

The backdoor Roth IRA strategy allows high-income earners to bypass these limits. Here’s how:

- Make a non-deductible contribution to a traditional IRA. [iii]

- Convert the funds into a Roth IRA. [iv]

This approach enables you to take advantage of the tax-free growth and withdrawals of a Roth IRA, even if your income exceeds the direct contribution limits.

Key Benefits of Backdoor Roth IRAs

Some of the benefits of backdoor Roth IRAs include:

- Tax-Free Growth: Investments grow tax-free within the account. [v]

- No RMDs: Roth IRAs offer flexibility by not requiring withdrawals during your lifetime.

- Income Limit Workaround: High earners can access Roth IRA benefits through this strategy.

Considerations and Potential Pitfalls

While the backdoor Roth IRA is a powerful strategy, it’s not without complexities:

- Tax Implications: Converting pre-tax contributions or earnings may trigger taxes.

- Pro-Rata Rule: Existing traditional IRA balances can complicate the tax calculations.

- Five-Year Rule: Converted funds must remain in the Roth IRA for at least five years to avoid penalties if withdrawn before age 59 ½.

Is the Backdoor Roth IRA Right for You?

Determining whether this strategy aligns with your financial goals requires a comprehensive understanding of your unique situation. Factors such as your current tax bracket, anticipated retirement tax rate, and long-term goals all play a role.

At Larson Financial Group, we specialize in holistic financial planning, looking beyond individual accounts to craft strategies that align with your broader financial picture. Whether you’re optimizing for tax efficiency, planning for retirement, or seeking to protect your wealth, we’re here to help you make informed decisions.

Take the Next Step

If you’re a high-income earner who has been unable to contribute to a Roth IRA, the backdoor Roth strategy may be your path to unlocking significant tax advantages.

Connect with your Larson advisor today to explore whether this approach fits into your financial plan. Together, we’ll ensure your retirement strategy empowers you to flourish now, and in the years to come.

[i] https://www.investopedia.com/retirement/roth-vs-traditional-ira-which-is-right-for-you/

[ii] https://investor.vanguard.com/investor-resources-education/iras/roth-ira-income-limits

[iii] https://www.wolterskluwer.com/en/expert-insights/backdoor-roth-ira-a-tax-saving-strategy-for-some-high-earners

[iv] https://www.fidelity.com/learning-center/personal-finance/backdoor-roth-ira

[v] https://www.investopedia.com/terms/b/backdoor-roth-ira.asp