News

Cybersecurity in 2025

Posted on March 18, 2025

Protecting Your

Wealth in a Digital Age

As financial transactions move increasingly online, cyber threats have become more sophisticated, targeting high-net-worth individuals, professionals, and financial institutions alike. Protecting your wealth today requires more than smart investing—it demands vigilance in securing your personal and financial data.

At Larson Financial Group, we believe true financial empowerment includes protecting clients from cyber risks. By staying informed about evolving threats and implementing proactive security measures, you can safeguard your assets from cybercriminals.

The Growing Cyber Threat Landscape

Cybercrime is a multibillion-dollar industry, and hackers are continuously refining their tactics. In 2025, these are the most pressing threats:

- AI-Driven Cyber Attacks: Artificial intelligence (AI) is being used by cybercriminals to craft highly convincing phishing emails, develop malware that adapts to evade detection, and create deepfake scams designed to steal financial information.[i]

- Ransomware & Data Extortion: Hackers no longer just lock down systems with ransomware; they also threaten to release sensitive financial data unless ransoms are paid. Financial institutions, wealth management firms, and investors – and even the United States Governments – are top targets.

- Cloud Security Risks: With many institutions adopting cloud-based services, hackers are exploiting vulnerabilities in cloud storage, applications, and third-party integrations to gain access to sensitive data.

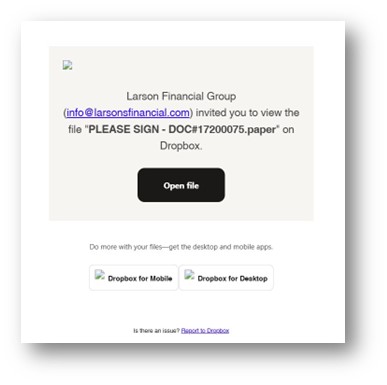

- Social Engineering & Phishing Scams: Phishing remains one of the most effective cyberattack strategies. Scammers use sophisticated impersonation tactics, mimicking banks and investment firms to steal login credentials and details.[ii]

- Distributed Denial-of-Service (DDoS) Attacks: These attacks flood banking servers with excessive traffic, temporarily shutting down access to accounts and online services. Often, they serve as distractions while hackers attempt more damaging breaches.

How to Protect Your Financial Future

Staying ahead of cybercriminals requires proactive security measures. Here’s how you can safeguard your financial data:

1. Strengthen Your Passwords & Use Multi-Factor Authentication (MFA)

- Use long, complex passwords for all financial accounts, stored in a password manager.

- Enable MFA whenever possible. This adds an extra layer of security beyond your password.

2. Stay Vigilant Against Phishing Attempts

- Phishing is the fraudulent practice of sending emails or other messages pretending to be from reputable companies to get individuals to reveal personal information such as passwords or credit card numbers.

- Be skeptical. Financial institutions will never ask for sensitive information via email.

- Hover over links before clicking. Verify suspicious messages with your financial providers directly.

- Threat actors will sometimes use a domain name very similar to a reputable domain in order to appear legitimate.

- In this example, please notice the “s” in “larsonsfinancial.com” rather than the usual “larsonfinancial.com”.

3. Secure Your Devices & Home Network

- Keep your computer, smartphone, and financial apps updated with the latest security patches.

- Use a secure, private Wi-Fi connection—avoid accessing sensitive financial accounts over public Wi-Fi.

- Install reputable security software to detect and prevent cyber threats.

4. Monitor Your Accounts & Credit Reports Regularly

- Review bank and investment statements frequently for suspicious transactions.

- Set up account alerts to notify you of large or unusual activity.

- Freeze your credit to prevent identity theft and check your credit report annually.

5. Use a Virtual Private Network (VPN) for Secure Browsing

- A VPN encrypts your internet connection, protecting your data from cybercriminals when using public networks. This is especially recommended when if you’re using an unsecured connection or when using public Wi-Fi.

- Additionally, mobile hotspots are more secure than public, unencrypted Wi-Fi (although message and data rates may apply).

6. Be Cautious with Third-Party Apps & Services

- Only use reputable financial tools that prioritize security.

- Review app permissions and avoid granting unnecessary access to your financial data.

The Role of Financial Institutions in Cybersecurity

At Larson Financial, we prioritize cybersecurity to safeguard your information and prevent fraud. While we cannot disclose specific security measures for operational integrity, we employ industry-leading practices to protect your data:

- Multi-Layered Security Approach: We implement a combination of encryption, real-time monitoring, and proactive threat detection to guard against cyber threats.

- Proactive Threat Monitoring: Advanced security systems continuously analyze activity to detect and mitigate potential risks before they escalate.

- Secure Client Communication: Sensitive information is transmitted only through protected channels to reduce exposure to cyber threats.

- Regulatory and Compliance Standards: We adhere to stringent cybersecurity regulations and best practices, ensuring compliance with evolving industry standards.

Cybersecurity is Financial Security

Cyber threats will continue to evolve. However, by staying informed and implementing strong security habits, you can take control of your financial future. And at Larson Financial, we are committed to empowering you with the knowledge and tools needed to protect your wealth.

Additionally, cybersecurity is a shared effort. Open communication is one of the most effective ways to prevent cybercrime. If you receive a suspicious email, text, or call that appears to come from Larson Financial Group or another financial institution, let us know immediately. Reporting phishing attempts and potential scams helps us strengthen our defenses and ensures we can take proactive measures to protect all of our clients.

Cybercriminals thrive in secrecy. When we openly discuss threats, share concerns, and remain transparent about attempted scams, we make it harder for attackers to operate in the shadows. By working together, including staying alert, reporting threats, and practicing safe online habits, we can create a more secure financial future for everyone.

If you have concerns about cybersecurity and its impact on your financial plan, reach out to your Larson advisor for expert guidance. Together, we can safeguard your assets from today’s digital threats.

[i] https://www.fintechfutures.com/2024/11/will-2025-be-the-turning-point-for-cybersecurity-in-finance/

[ii] https://cybersecurity.asee.io/blog/top-banking-security-trends/

Stay caught up.

Watch our most recent Weekly Market Commentaries to make sure you know what’s happening in the markets each week.