Wealthy Behaviors

Understanding Educational Return on Investment

Posted on June 26, 2024

As a savvy investor, you already know about ROI (Return on Investment) and why it’s important. But have you considered educational ROI?

In today’s competitive job market, understanding the return on investment of a degree is essential. For many parents and their college-bound children, the expectation is that higher education will lead to a lucrative career. However, the financial benefits of a degree can vary significantly based on the chosen major and institution.

Our focus on holistic planning extends beyond traditional financial services to encompass all aspects of your life and family. As such, we wanted to share a new tool created by the Foundation for Research on Equal Opportunity (FREOPP) which offers invaluable insights into the ROI of over 40,000 undergraduate and 10,000 graduate programs. By using data from the federal College Scorecard and the Census Bureau’s American Community Survey, this tool estimates lifetime earnings for various degree programs.

According to the FREOPP, educational ROI is defined as, “the increase in lifetime earnings that a student can expect when they enroll in a certain degree program, minus the costs of tuition and fees, books and supplies, and lost earnings while enrolled.”[i]

While many of our clients already have well-established 529 plans for your family’s educational needs, it is still important to evaluate the ROI of college degrees. Even children of high-net-worth individuals—who will most likely graduate debt-free—should be empowered to make informed academic decisions to help secure their own financial future. And having access to detailed and comprehensive information can help you make more informed decisions about which majors and schools can provide the best financial returns over a graduate’s career.

Associate and Certificate Programs

When considering associate degrees and certificate programs, the ROI can vary significantly. While liberal arts associate degrees tend to have no ROI, technical trade certificates often outperform the typical bachelor’s degree in financial returns. This highlights the importance of choosing the right field of study even at the associate level.

Bachelor’s Degrees

Bachelor’s programs generally offer a median ROI of $160,000. However, the ROI varies widely, with 23% of graduates experiencing a negative ROI, while 6% enjoy an ROI above $1 million. Notably, the highest ROI comes from Princeton University’s computer engineering program, boasting an impressive $7.1 million.

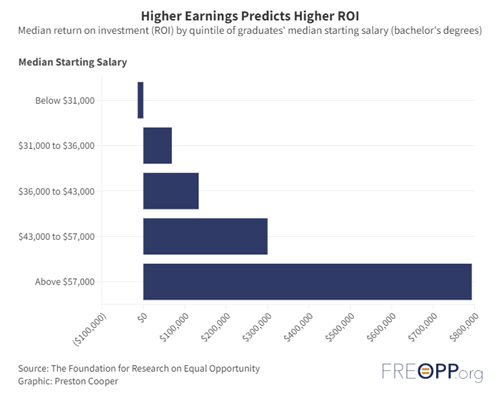

Additionally, the starting salary plays a critical role in determining ROI, with degrees offering initial salaries below $31,000 likely to result in negative returns, while those starting at $57,000 or more provide the highest returns.

Graduate and Doctoral Degrees

Graduate degrees present a more complex picture, with nearly half of master’s degree holders experiencing negative ROI due to high program costs and modest salary increases. Even popular programs like the MBA can sometimes yield low or negative financial returns. In contrast, professional degrees in fields such as law, medicine, and dentistry offer significantly better ROIs. However, PhD programs can sometimes result in negative ROIs, with civil engineering being a notable example with consistently poor financial outcomes.

Using the Tool

Using FREOPP’s tool can reveal significant variations in ROI within the same academic major across different institutions. For instance, the ROI for a business degree at the University of Virginia exceeds $3 million, yet 13% of business programs overall have a negative ROI. This underscores the importance of researching specific programs and institutions to make the best financial decisions. To research educational ROI, use these links:

Play around with these resources. Here’s some criteria you can search by:

- Field of Study

- State

- Type of Institution

- Specific Institution

- Type of Degree or Credential

Maximizing Educational ROI Through 529 Plans

While not all degrees offer the highest financial returns, many individuals pursue them out of passion and a desire to make a meaningful impact. Fields like the arts, humanities, and social work attract those driven by creativity, intellectual curiosity, and a commitment to social change. Aspiring artists, writers, and musicians often choose their paths not for lucrative salaries, but for the fulfillment and personal expression their work provides. Similarly, those drawn to social work may prioritize the profound satisfaction of helping others over financial gain, dedicating their lives to supporting vulnerable populations and advocating for social justice.

One way to maximize educational ROI is to ensure you graduate with as little student loan debt as possible. Aside from grants and scholarships, consider opening a 529 plan. 529 plans are tax-advantaged savings plans designed to help individuals and families save for educational expenses. Anyone can open and fund a 529 savings plan, even if they’re not related to the beneficiary.

529 plans have become increasingly flexible, allowing funds to be used for a wide range of education-related expenses. This includes certain room and board costs, and in some states, even K-12 education expenses and vocational schools are covered. High contribution limits allow families to save substantial amounts, ensuring they are well-prepared to cover education costs.

Additionally, contributions to 529 plans can be considered gifts for tax purposes, providing estate planning benefits by allowing significant contributions without triggering gift tax consequences, within the annual and lifetime gift limits.

Contributions to 529 plans are made with after-tax dollars, but the earnings on these contributions grow tax-free. Moreover, withdrawals for qualified education expenses, such as tuition, fees, books, and supplies, are also tax-free, leading to significant tax savings over time.

We understand the true value of an education extends beyond monetary ROI.

We believe in empowering our clients and their children to pursue their dreams, whether that means becoming a renowned artist, a passionate doctor or lawyer, or a dedicated social worker. Our role is to ensure these aspirations are supported by sound financial planning, allowing you to achieve your goals without compromising your financial security. Through holistic financial planning and by focusing on the whole picture, we can help you balance your passions with practical considerations, enabling you to make informed decisions which align with your personal values and dreams.

Our dedication to you means looking beyond immediate financial metrics to consider the long-term impacts of educational choices. If you have children or grandchildren who will be headed off to college someday, talk to us today about starting a 529 plan to maximize their educational ROI.

[i] https://freopp.org/does-college-pay-off-a-comprehensive-return-on-investment-analysis-563b9cb6ddc5