News

Election Results Are In

Posted on November 20, 2024

What’s next?

Now that the 2024 presidential election is over, we can finally take a breather from all the political ads, daily emails, and barrage of text messages.

We are witnessing history in the making, as former President Donald Trump is set to return to the White House. He will be only the second president to win non-consecutive terms. And with Republicans securing majorities in both the House and Senate, expectations are high for significant legislative action on taxes, trade, and economic policy.

While it’s yet to be seen how the election results will directly affect the economy, inflation, and taxes, we can infer several scenarios. It’s important to note these are potential outcomes based on campaign promises and proposed policies. The actual implementation and economic effects may vary depending on various factors, including global economic conditions and legislative processes.

Economic Outlook: Growth and Challenges Ahead

Certain industries, such as fossil fuels and traditional manufacturing, are already seeing renewed investor interest. Financials and energy sectors have shown resilience in market movements since the election, while technology and renewable energy face potential uncertainties due to expected policy shifts:

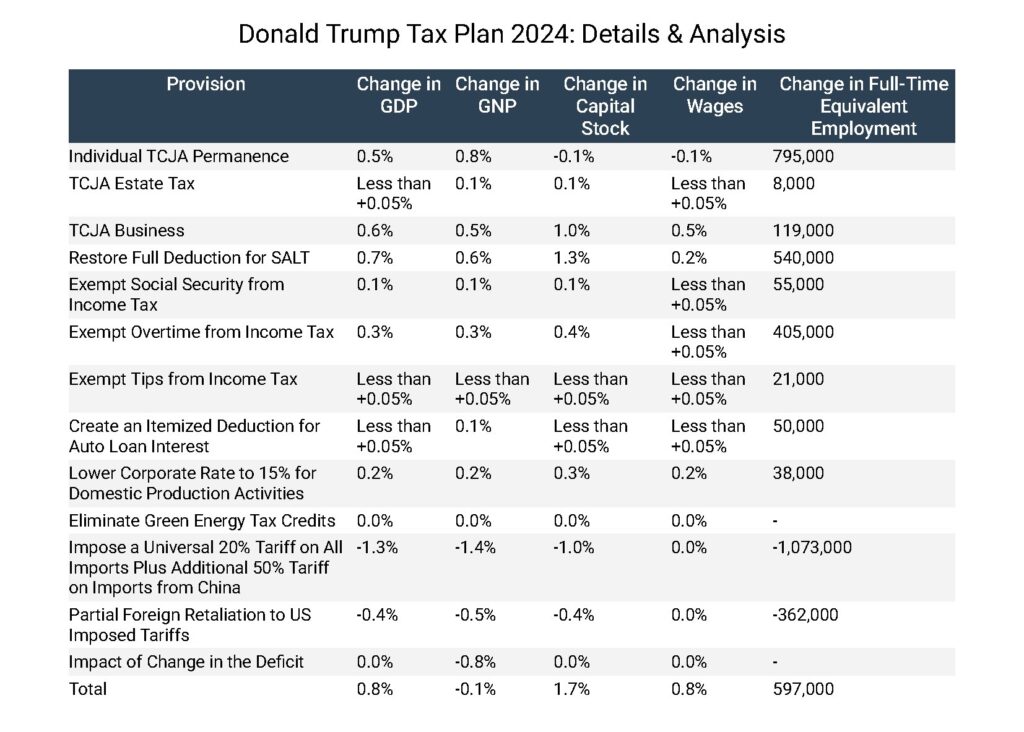

- Corporate Tax Cuts: President-elect Trump’s victory suggests a shift towards more business-friendly policies. This could boost investor confidence in the short term, and his plan to lower the corporate tax rate from 21% to 15% could stimulate business investment and job creation.[i] However, the fiscal implications of such a measure are likely to raise concerns about long-term debt sustainability.

- Deregulation: A “light-touch” regulatory environment is anticipated, with sectors such as energy, banking, and capital markets expected to benefit. This policy could encourage business expansion and reduce compliance costs.

Inflation: a Balancing Act for the Federal Reserve

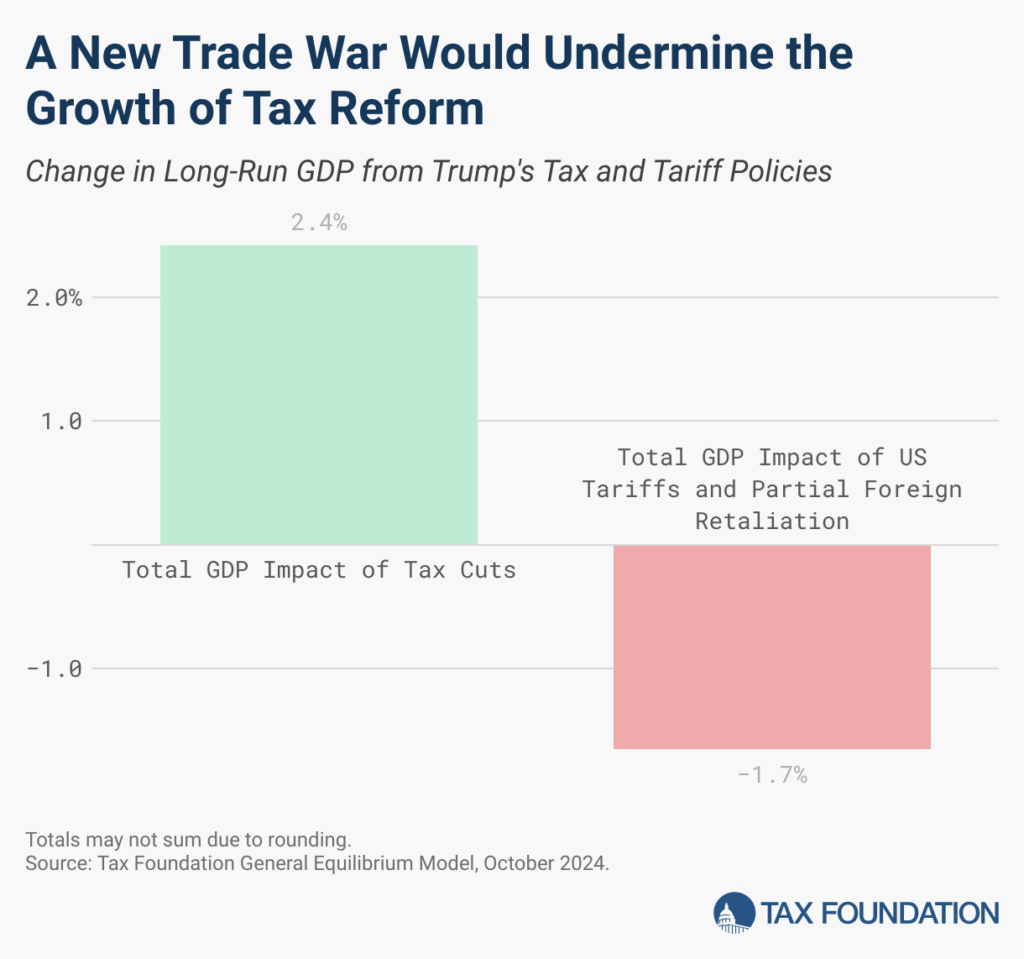

Trump’s trade policies—particularly tariffs on imports—could introduce inflationary pressures:

- Higher Consumer Prices: Tariffs could lead to increased costs for imported goods, particularly from China, fueling inflation.[ii]

- Monetary Policy: The Federal Reserve is likely to be closely watched as it navigates inflation management while supporting economic growth. Comments by Fed Chair Jerome Powell suggest caution, with the central bank hesitant to cut rates amid a strong economy.

Taxes: Lower Rates, Higher Deficits?

Republicans will likely move quickly in 2025 to extend key provisions from the 2017 Tax Cuts and Jobs Act, including lower individual income tax rates and expanded estate tax exemptions. Additional proposals include:

- Social Security: Proposals to eliminate taxes on Social Security benefits could benefit retirees.

- SALT Deduction: The potential repeal of the SALT (State and Local Taxes) deduction cap would provide relief to high-income earners in high-tax states.[iii]

- New Deductions: Trump’s plans include making auto loan interest deductible and eliminating taxes on tips and overtime pay, measures that could provide relief to middle- and lower-income households.

The high cost of these changes could force lawmakers to make tough budgetary decisions. The combined effect of tax cuts and increased spending is projected to add over $3 trillion to the national debt over the next decade. While the policies may stimulate short-term growth, they raise concerns about long-term fiscal stability.

International Trade: Tariffs and Global Relations

Broad-based tariffs on imports, including those from China, could reshape global trade dynamics. While such measures aim to protect domestic industries, they also risk retaliation from trading partners. This could potentially disrupt supply chains, thereby impacting U.S. exports. Industries reliant on global trade, such as automotive and technology, could face increased costs. On the other hand, domestic manufacturing and agriculture might benefit from reduced competition.

Legislative and Policy Considerations

Although Republicans hold a unified government, achieving legislative goals may not be without hurdles. Factors include:

- Debt Ceiling Debate: The debt ceiling returns in January 2025 after a suspension since mid-2023. This could lead to contentious negotiations, especially with a $1.8 trillion budget deficit and over $35 trillion in national debt. Expect markets to react to discussions pairing spending cuts with a debt ceiling increase.

- Reconciliation Process: To bypass Senate supermajority requirements, Republicans may use the budget reconciliation process for tax and spending measures, expediting major policy changes.

So, What Lies Ahead?

The market’s early reaction to the election has been mixed, with potential opportunities and risks:

- Gains in Traditional Sectors: Financials and energy stocks have shown gains, reflecting optimism about deregulation and tax policies.

- Sector Volatility: Technology, healthcare, and materials have experienced losses amid uncertainty over potential policy changes.

While short-term market movements reflect immediate reactions, a disciplined, long-term investment approach remains key during times of policy transition.

Larson Perspective: Staying Disciplined Amid Uncertainty

The unified Republican government signals potential policy shifts which could influence inflation, tax policy, and economic growth. The months ahead will bring greater clarity as legislative priorities take shape and policy proposals materialize.

For investors, the focus should remain on navigating these changes with a balanced, informed strategy. We remain focused on empowering you to thrive through disciplined financial strategies, regardless of market volatility. And we are committed to providing steady guidance and a disciplined approach to stay focused on the big picture.

We are here to help to ensure your financial goals stay on track, regardless of changes in the political landscape. If you do have questions, however, now is a great time to talk to your advisor about preparing for potential tax changes, trade developments, and other possible regulatory shifts.

[i] https://taxfoundation.org/research/all/federal/donald-trump-tax-plan-2024/

[ii] https://www.cbsnews.com/news/kamala-harris-trump-tax-cuts-election-2024-what-to-know/

[iii] https://taxfoundation.org/research/all/federal/donald-trump-tax-plan-2024/