Weekly Market Commentary

Emerging Markets Lag as Fed Comments Stir Caution

Posted on November 21, 2024

Emerging Markets Lag as Fed Comments Stir Caution

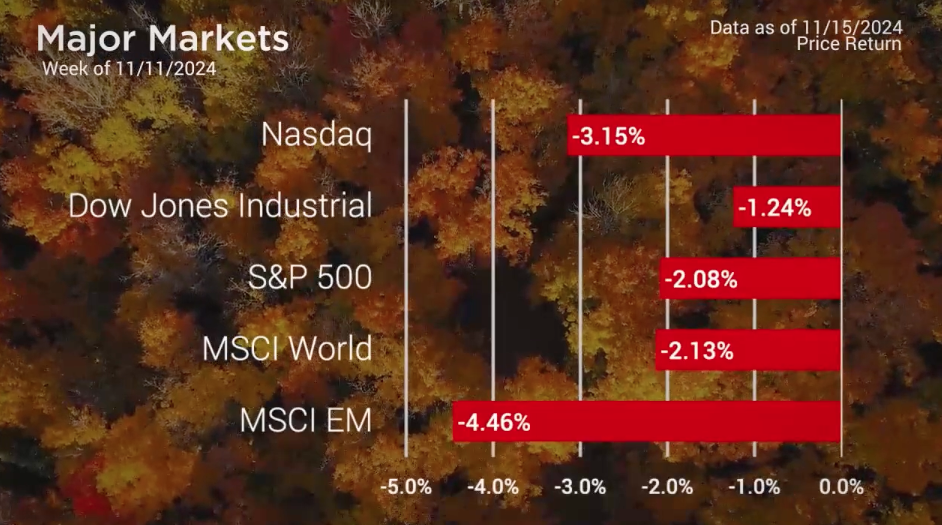

The post-election pop fizzled last week with losses across the board. The greatest losses were in Emerging Markets. Emerging Markets has fallen the last few weeks as the dollar has strengthened. Some analysts have attributed this pullback, at least in part, to the possibility of future tariffs and other policy changes ahead of a Trump presidency.

That said, the broad domestic market also dropped last week. Small and Mid-cap fared even worse than Large Caps. Sentiment shifted away from growth back toward value. In some respects, this type of pullback is to be expected after a week like the one prior which saw a jump over four and a half percent.

Possibly the greater impetus for the pullback last week was due to comments made by Fed Chairman Jerome Powell Thursday in a speech in Dallas. In his remarks, he said:

“We are moving policy over time to a more neutral setting. But the path for getting there is not preset. In considering additional adjustments to the target range for the federal funds rate, we will carefully assess incoming data, the evolving outlook, and the balance of risks. The economy is not sending any signals that we need to be in a hurry to lower rates. The strength we are currently seeing in the economy gives us the ability to approach our decisions carefully. Ultimately, the path of the policy rate will depend on how the incoming data and the economic outlook evolve.“

Major Markets |

YTD as of 11/15/2024 | ||

| Nasdaq |  |

||

| Dow Jones Industrial |  |

||

| S&P 500 |  |

||

| MSCI World |  |

||

| MSCI EM |  |

||

| Russell 2000 |  |

||

| Bar US Agg Bnd |  |

||

|

|||

S&P Sectors |

|

|||||

| Comm. Services |  |

|||||

| Cons. Discretionary |  |

|||||

| Cons. Staples |  |

|||||

| Energy |  |

|||||

| Financials |  |

|||||

| Health Care |  |

|||||

| Industrials |  |

|||||

| Info. Technology |  |

|||||

| Materials |  |

|||||

| Real Estate |  |

|||||

| Utilities |  |

|||||

|

||||||

| Agent/Broker Dealer Use Only | ||||||

These comments were largely copied from his post-FOMC press conference from the week prior that accompanied a 25-basis point cut. However, the words seemed to carry more weight last week. The S&P 500 fell by 60-basis points Thursday on the heels of his comments. The index opened lower Friday, with the majority of the weekly losses occurring that session, going into the weekend.

Yet, there was a hint of green at the sector level as energy and financials where the two segments that managed to add to their year-to-date gains.

Treasuries also saw the yield curve rise as the curve steepened ever so slightly from the prior week.

https://www.federalreserve.gov/mediacenter/files/FOMCpresconf20241107.pdf

https://www.federalreserve.gov/newsevents/speech/powell20241114a.htm

Concerned about inflation? Check out our Tips to Reduce Risks In Case of Recession.

| The S&P 500® Index is a capitalization index of 500 stock-designed to measure performance of the broad domestic economy through changes in the aggregate market value of stock representing all major industries. https://us.spindices.com/indices/equity/sp-500 The Dow Jones Industrial Average® (The Dow®), is a price-weighted measure of 30 U.S. blue-chip companies. The index covers all industries except transportation and utilities. https://us.spindices.com/indices/equity/dow-jones-industrial-average The NASDAQ Composite Index measures all NASDAQ domestic and international based common type stocks listed on The NASDAQ Stock Market. Today the NASDAQ Composite includes over 2,500 companies, more than most other stock market indexes. Because it is so broad-based, the Composite is one of the most widely followed and quoted major market indexes. https://indexes.nasdaqomx.com/Index/Overview/COMP The MSCI World Index, which is part of The Modern Index Strategy, is a broad global equity benchmark that represents large and mid-cap equity performance across 23 developed markets countries. It covers approximately 85% of the free float-adjusted market capitalization in each country and MSCI World benchmark does not offer exposure to emerging markets. The MSCI Emerging Markets (EM) Index is designed to represent the performance of large- and mid-cap securities in 24 Emerging Markets countries of the Americas, Europe, the Middle East, Africa and Asia. As of December 2017, it had more than 830 constituents and covered approximately 85% of the free float-adjusted market capitalization in each country. https://www.msci.com/ The S&P GSCI Crude Oil index provides investors with a reliable and publicly available benchmark for investment performance in the crude oil market. https://us.spindices.com/indices Companies in the S&P 500 Sector Indices are classified based on the Global Industry Classification Standard (GICS®). https://us.spindices.com/indices |