Weekly Market Commentary

Global Markets Rise Amid China Slowdown

Posted on October 25, 2024

Global Markets Rise Amid China Slowdown

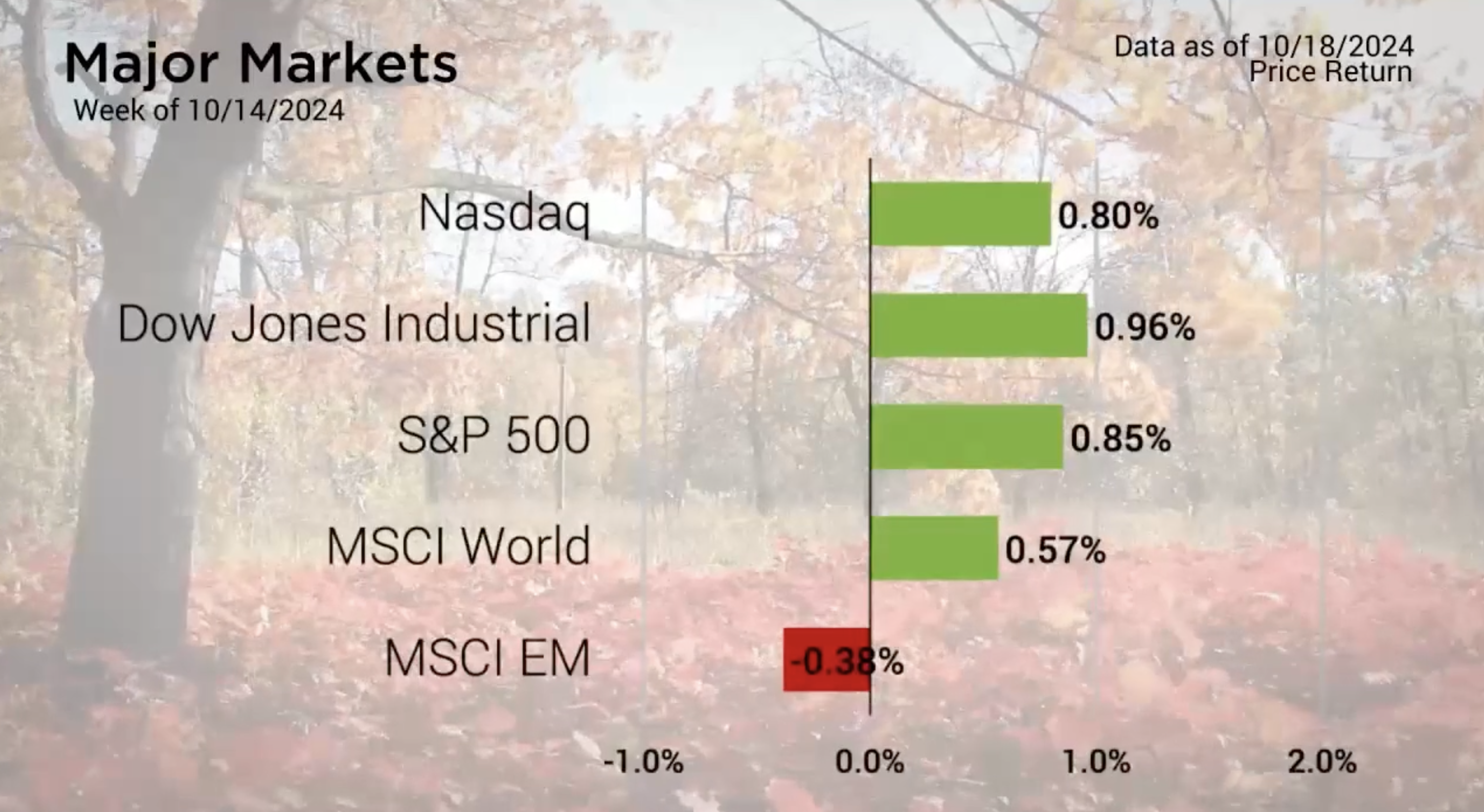

The Major Markets closed mostly higher with Emerging Markets being the lone benchmark closing lower again. The waning performance of China pulled on the emerging market index for the second week in a row as details continue to be sparse out of the country on what exactly the government plans to do to turn their economy around.

In economic news, the IEA updated their 2024 guidance on World Oil Demand last week. The report highlighted that global demand appeared to be settling around 900,000 barrels per day with 2025 estimated to be slightly higher at 1mb/d. This is a stark contrast from the 2mb/d clip that the global economy demanded in the post covid years of 2022 and 2023. China was singled out as a significant contributor for this slowdown as the country accounted for an astounding 70% of demand in 2023.

Major Markets |

YTD as of 10/18/2024 | ||

| Nasdaq |  |

||

| Dow Jones Industrial |  |

||

| S&P 500 |  |

||

| MSCI World |  |

||

| MSCI EM |  |

||

| Russell 2000 |  |

||

| Bar US Agg Bnd |  |

||

|

|||

S&P Sectors |

|

|||||

| Comm. Services |  |

|||||

| Cons. Discretionary |  |

|||||

| Cons. Staples |  |

|||||

| Energy |  |

|||||

| Financials |  |

|||||

| Health Care |  |

|||||

| Industrials |  |

|||||

| Info. Technology |  |

|||||

| Materials |  |

|||||

| Real Estate |  |

|||||

| Utilities |  |

|||||

|

||||||

| Agent/Broker Dealer Use Only | ||||||

Stateside, the S&P 500 and the Dow Jones Average both logged fresh all-time highs. The 85-basis point gain in the S&P 500 was the result of positive sentiment overall with Energy and Health Care marking the only negative performance among the sectors.

The Health Care sector was impacted by poor guidance results from Unitedhealth Group Inc following the company’s Q3 earnings call . Due to the company’s weighting within the sector, this caused the company to pull heavily on the overall sector. This pullback was a powerful example of the impact that some companies can have in the midst of earnings season.

The Q3 earnings season began in earnest last week with 224 companies reporting. This number will continue to climb until mid-November with over 1800 companies reporting earnings and guidance a couple weeks ahead of the Thanksgiving holiday and the start of the holiday season.

In the midst of earnings season, the FOMC is anticipated to lower the fed funds rate by another 25 basis points. The CME Group’s FedWatch tool continued to see the odds firm up around a quarter point cut for November 7th. However, the December meeting has seen the odds of another 25-basis point cut weaken.

https://www.iea.org/reports/oil-market-report-october-2024#overview

https://www.unitedhealthgroup.com/newsroom/2024/2024-10-15-uhg-reports-third-quarter-results.html

Concerned about inflation? Check out our Tips to Reduce Risks In Case of Recession.

| The S&P 500® Index is a capitalization index of 500 stock-designed to measure performance of the broad domestic economy through changes in the aggregate market value of stock representing all major industries. https://us.spindices.com/indices/equity/sp-500 The Dow Jones Industrial Average® (The Dow®), is a price-weighted measure of 30 U.S. blue-chip companies. The index covers all industries except transportation and utilities. https://us.spindices.com/indices/equity/dow-jones-industrial-average The NASDAQ Composite Index measures all NASDAQ domestic and international based common type stocks listed on The NASDAQ Stock Market. Today the NASDAQ Composite includes over 2,500 companies, more than most other stock market indexes. Because it is so broad-based, the Composite is one of the most widely followed and quoted major market indexes. https://indexes.nasdaqomx.com/Index/Overview/COMP The MSCI World Index, which is part of The Modern Index Strategy, is a broad global equity benchmark that represents large and mid-cap equity performance across 23 developed markets countries. It covers approximately 85% of the free float-adjusted market capitalization in each country and MSCI World benchmark does not offer exposure to emerging markets. The MSCI Emerging Markets (EM) Index is designed to represent the performance of large- and mid-cap securities in 24 Emerging Markets countries of the Americas, Europe, the Middle East, Africa and Asia. As of December 2017, it had more than 830 constituents and covered approximately 85% of the free float-adjusted market capitalization in each country. https://www.msci.com/ The S&P GSCI Crude Oil index provides investors with a reliable and publicly available benchmark for investment performance in the crude oil market. https://us.spindices.com/indices Companies in the S&P 500 Sector Indices are classified based on the Global Industry Classification Standard (GICS®). https://us.spindices.com/indices |