Weekly Market Commentary

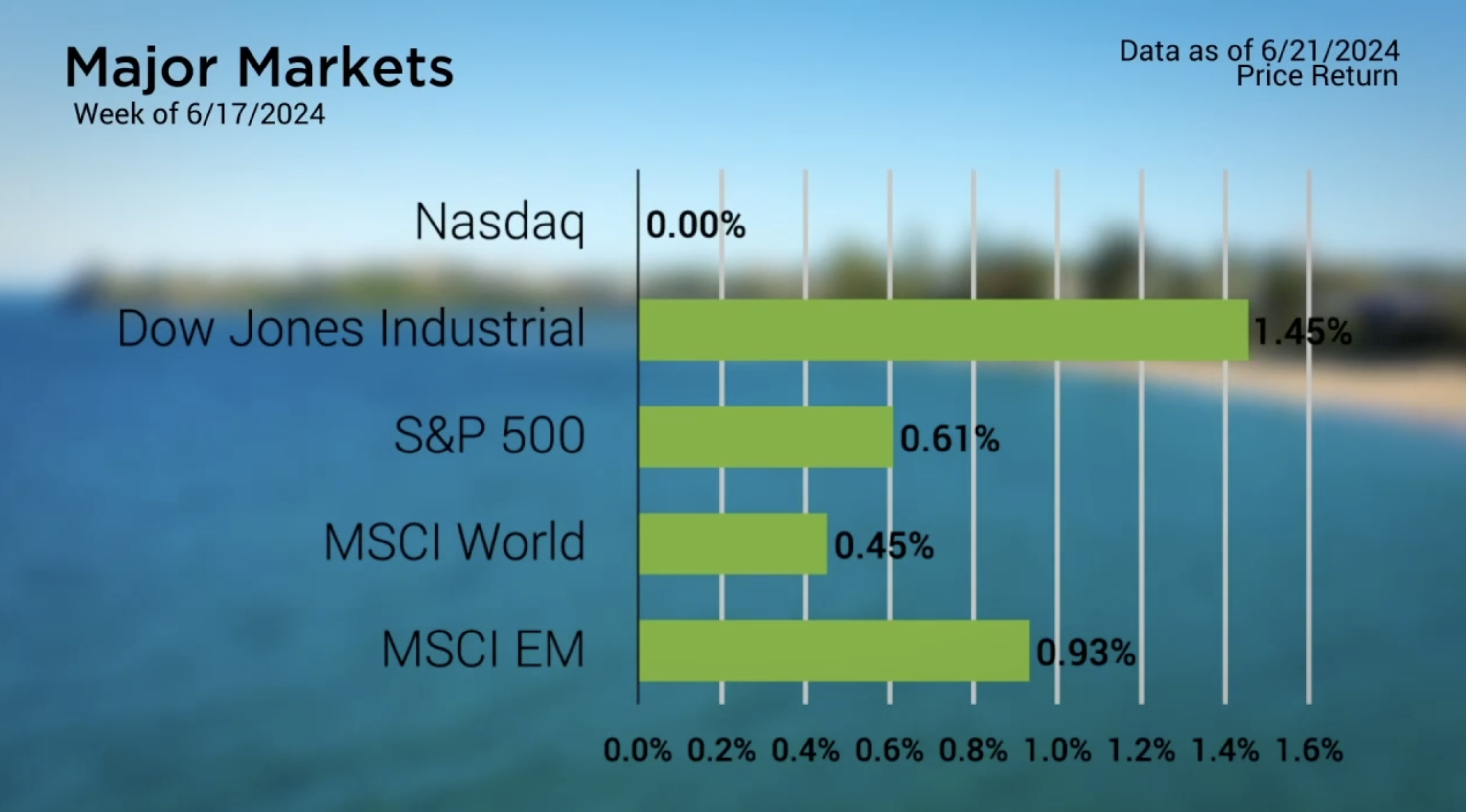

Major Markets Close Higher in Juneteenth Shortened Week

Posted on June 26, 2024

All five Major Markets closed higher during last week’s Juneteenth shortened trading week. While the gains in the Nasdaq were effectively nonexistent, the Dow Jones Industrial Average managed to lead the pack, adding a nearly one a half percent gain. In a lot of ways, last week served as a cooling off week, while still positive, for segments of the markets that have been on a tear in recent weeks.

For example, the Large Cap Blend and Growth segments were the lowest performing style boxes of the nine. Mid Cap Growth saw the greatest gains after weeks of value and smid-cap markets struggling relative to the outperformance of the Large Cap Growth tilt of the style boxes.

Breaking the market across the sectors, we see a similar reversal of fate for the IT sector. After making headlines for its significant gains this month, last week was an opportunity for other segments of the market to have a moment to shine. Consumer Discretionary added two and half percent to stand out as the best performing sector for the week, making up for some of the weakness this area has had year-to-date.

Major Markets |

YTD as of 6/21/2024 | ||

| Nasdaq |  |

||

| Dow Jones Industrial |  |

||

| S&P 500 |  |

||

| MSCI World |  |

||

| MSCI EM |  |

||

| Russell 2000 |  |

||

| Bar US Agg Bnd |  |

||

|

|||

S&P Sectors |

|

|||||

| Comm. Services |  |

|||||

| Cons. Discretionary |  |

|||||

| Cons. Staples |  |

|||||

| Energy |  |

|||||

| Financials |  |

|||||

| Health Care |  |

|||||

| Industrials |  |

|||||

| Info. Technology |  |

|||||

| Materials |  |

|||||

| Real Estate |  |

|||||

| Utilities |  |

|||||

|

||||||

| Agent/Broker Dealer Use Only | ||||||

There was little news of significance last week outside of the S&P 500 crossing the 5500 milestone for the first time as it continued to set new record highs.

For Economic Data, Home Prices came out with a new all-time high in nationwide home prices with a median average of $419,300. That said, Housing Starts and New Permits reached their lowest level post the Covid drop. Additionally, existing home sales fell for a third month in a row to the lowest level since January. This has created a unique environment where home prices remain elevated, yet the housing market has somewhat stalled out due to higher interest rates.

Concerned about inflation? Check out our Tips to Reduce Risks In Case of Recession.

| The S&P 500® Index is a capitalization index of 500 stock-designed to measure performance of the broad domestic economy through changes in the aggregate market value of stock representing all major industries. https://us.spindices.com/indices/equity/sp-500 The Dow Jones Industrial Average® (The Dow®), is a price-weighted measure of 30 U.S. blue-chip companies. The index covers all industries except transportation and utilities. https://us.spindices.com/indices/equity/dow-jones-industrial-average The NASDAQ Composite Index measures all NASDAQ domestic and international based common type stocks listed on The NASDAQ Stock Market. Today the NASDAQ Composite includes over 2,500 companies, more than most other stock market indexes. Because it is so broad-based, the Composite is one of the most widely followed and quoted major market indexes. https://indexes.nasdaqomx.com/Index/Overview/COMP The MSCI World Index, which is part of The Modern Index Strategy, is a broad global equity benchmark that represents large and mid-cap equity performance across 23 developed markets countries. It covers approximately 85% of the free float-adjusted market capitalization in each country and MSCI World benchmark does not offer exposure to emerging markets. The MSCI Emerging Markets (EM) Index is designed to represent the performance of large- and mid-cap securities in 24 Emerging Markets countries of the Americas, Europe, the Middle East, Africa and Asia. As of December 2017, it had more than 830 constituents and covered approximately 85% of the free float-adjusted market capitalization in each country. https://www.msci.com/ The S&P GSCI Crude Oil index provides investors with a reliable and publicly available benchmark for investment performance in the crude oil market. https://us.spindices.com/indices Companies in the S&P 500 Sector Indices are classified based on the Global Industry Classification Standard (GICS®). https://us.spindices.com/indices |