Weekly Market Commentary

Market Dip Amid Earnings and Election Uncertainty

Posted on November 8, 2024

Market Dip Amid Earnings and Election Uncertainty

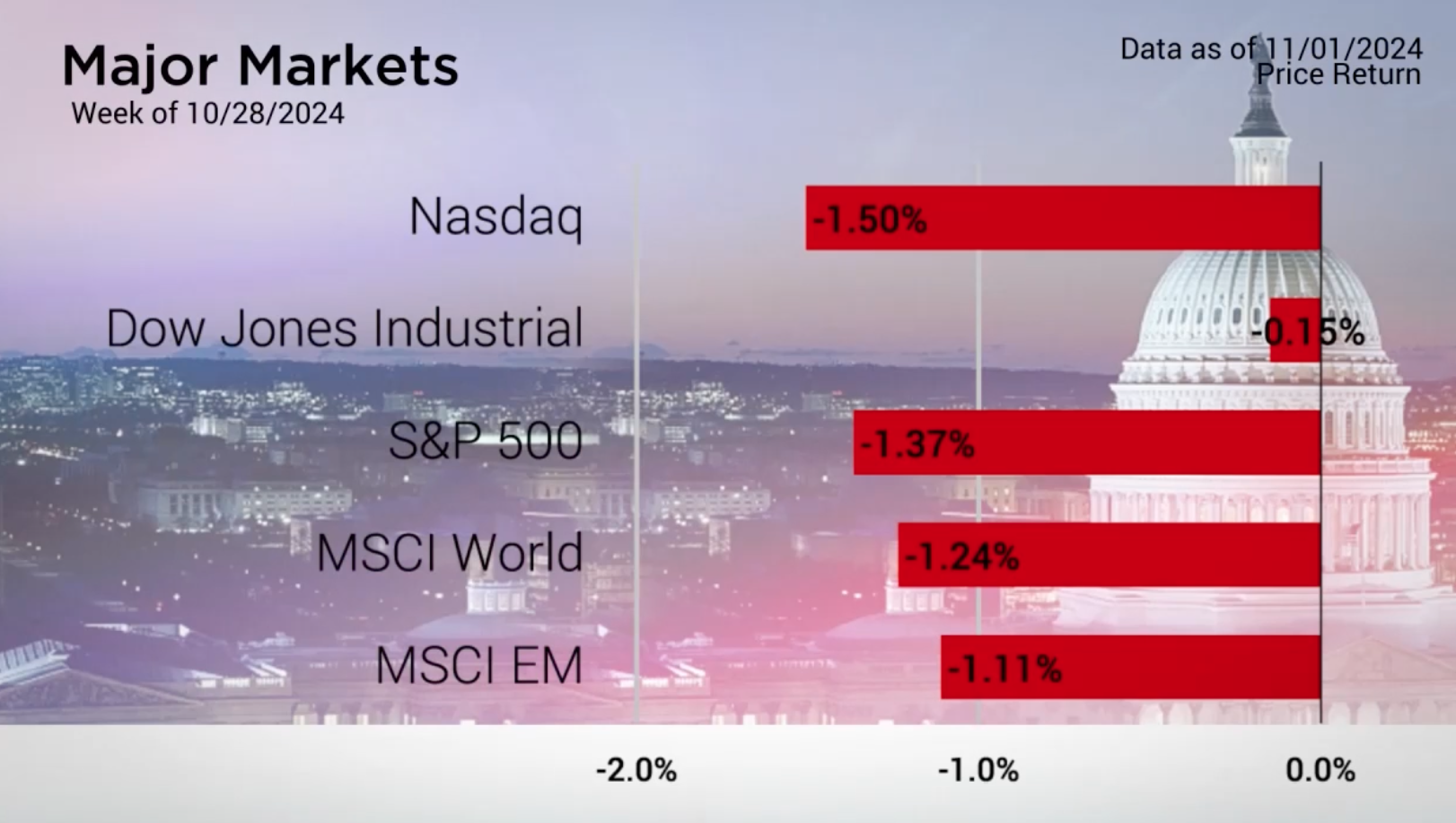

This served as the second week in a row that the broad domestic market closed lower. Although the Nasdaq Composite managed to close in positive territory the prior week, the index served as the biggest loser last week. The pullback in the domestic market served as a bit of a down note for the end of October. This was enough to cause the major markets to end the month lower as well, as a result.

Earnings season is in full swing with 70% of the S&P 500 companies having reported. As FactSet reports, 75% of the companies that have posted their earnings have seen an earnings per share beat. This is in line with 10-year average of companies beating their estimates but below the 5-year average.

Furthermore, if the cumulative Q3 earnings growth rate holds through the rest of the quarter’s releases, this would mark the fifth consecutive quarter of year-over-year growth for the S&P 500.

The earnings calendar was also loaded last week. Consumer Confidence significantly beat forecast with a headline number of 108.7 compared to the 99.5 expected and prior reading of 99.2. Meanwhile, the JOLTs report showed that Job Openings dropped to 7.44M for the Total Nonfarm jobs. This is in line with the pre-pandemic highs and serves as a fresh low following the February 2021 pop.

GDP came in at 2.8%, which was cooler than the 3.1% expected and below the 3.0% recorded in Q2.

Major Markets |

YTD as of 11/01/2024 | ||

| Nasdaq |  |

||

| Dow Jones Industrial |  |

||

| S&P 500 |  |

||

| MSCI World |  |

||

| MSCI EM |  |

||

| Russell 2000 |  |

||

| Bar US Agg Bnd |  |

||

|

|||

S&P Sectors |

|

|||||

| Comm. Services |  |

|||||

| Cons. Discretionary |  |

|||||

| Cons. Staples |  |

|||||

| Energy |  |

|||||

| Financials |  |

|||||

| Health Care |  |

|||||

| Industrials |  |

|||||

| Info. Technology |  |

|||||

| Materials |  |

|||||

| Real Estate |  |

|||||

| Utilities |  |

|||||

|

||||||

| Agent/Broker Dealer Use Only | ||||||

The week ended with the October release of the BLS Employment Report. The headline addition of 12,000 new jobs was a significant miss from the 110,000 expected and the previous reading of 223,000. Digging deeper, we see that of the total nonfarm payroll numbers, the private sector shrunk by 28,000 jobs while the government sector offset the losses with 40,000 jobs to keep the number positive.

Finally, this week is election week. Tuesday’s 2024 presidential election is noteworthy for numerous reasons. Former president Donald Trump is one of a few who have run for office an additional time after a period out of office. Similarly, President Biden is only one of a handful of presidents who have decide not to run for reelection. And if Kamala Harris does succeed in winning the election, she’ll serve as the first woman president of the United States.

If you need help finding your polling location, you can find the link to each state’s polling locations from vote.org.

https://insight.factset.com/sp-500-earnings-season-update-november-1-2024

https://www.vote.org/polling-place-locator/

Concerned about inflation? Check out our Tips to Reduce Risks In Case of Recession.

| The S&P 500® Index is a capitalization index of 500 stock-designed to measure performance of the broad domestic economy through changes in the aggregate market value of stock representing all major industries. https://us.spindices.com/indices/equity/sp-500 The Dow Jones Industrial Average® (The Dow®), is a price-weighted measure of 30 U.S. blue-chip companies. The index covers all industries except transportation and utilities. https://us.spindices.com/indices/equity/dow-jones-industrial-average The NASDAQ Composite Index measures all NASDAQ domestic and international based common type stocks listed on The NASDAQ Stock Market. Today the NASDAQ Composite includes over 2,500 companies, more than most other stock market indexes. Because it is so broad-based, the Composite is one of the most widely followed and quoted major market indexes. https://indexes.nasdaqomx.com/Index/Overview/COMP The MSCI World Index, which is part of The Modern Index Strategy, is a broad global equity benchmark that represents large and mid-cap equity performance across 23 developed markets countries. It covers approximately 85% of the free float-adjusted market capitalization in each country and MSCI World benchmark does not offer exposure to emerging markets. The MSCI Emerging Markets (EM) Index is designed to represent the performance of large- and mid-cap securities in 24 Emerging Markets countries of the Americas, Europe, the Middle East, Africa and Asia. As of December 2017, it had more than 830 constituents and covered approximately 85% of the free float-adjusted market capitalization in each country. https://www.msci.com/ The S&P GSCI Crude Oil index provides investors with a reliable and publicly available benchmark for investment performance in the crude oil market. https://us.spindices.com/indices Companies in the S&P 500 Sector Indices are classified based on the Global Industry Classification Standard (GICS®). https://us.spindices.com/indices |