Weekly Market Commentary

Markets Gain Amid Mixed Earnings and Sector Shifts

Posted on November 26, 2024

Markets Gain Amid Mixed Earnings and Sector Shifts

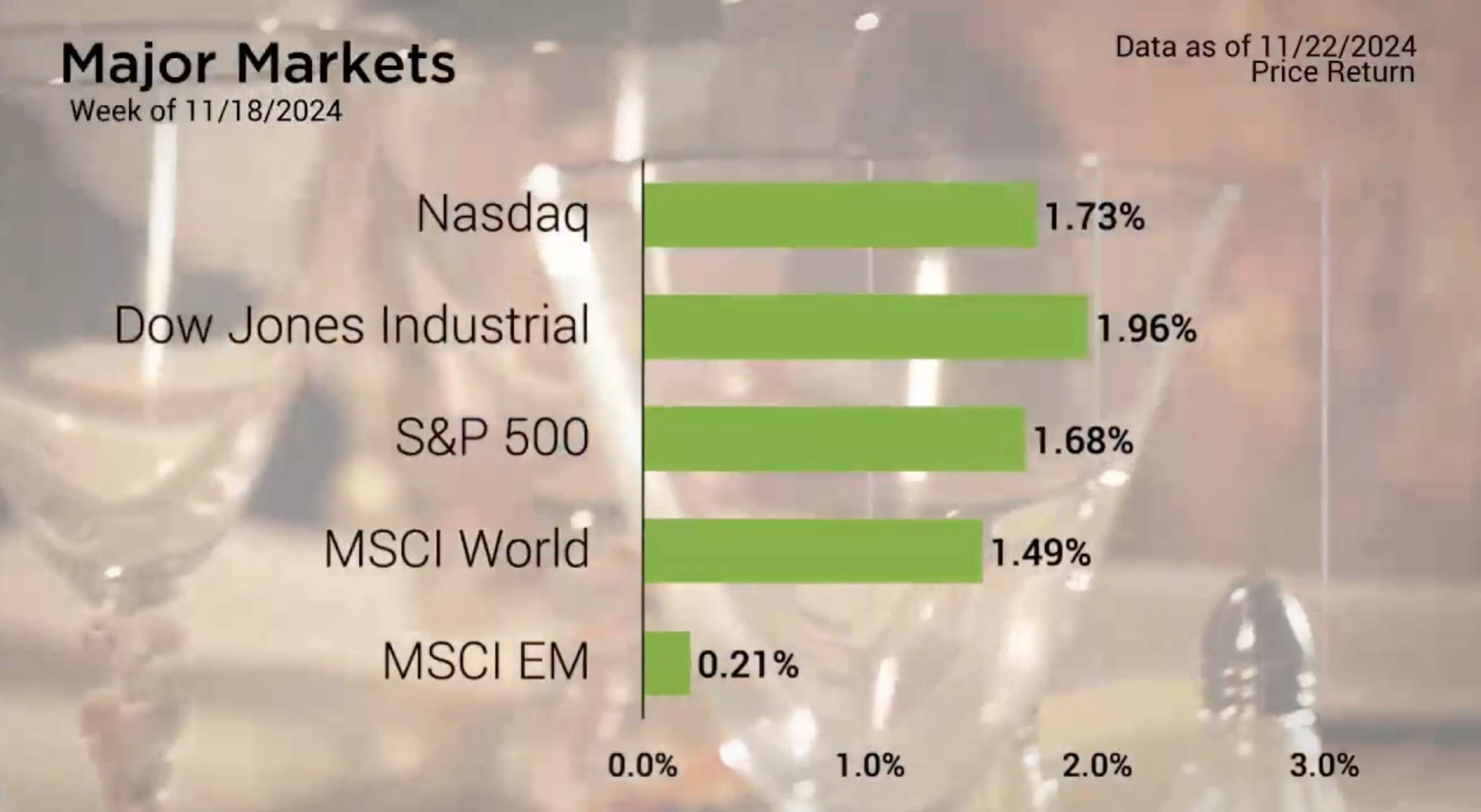

The Major Markets saw gains across the board once again last week. The S&P 500, like much of the domestic market, has alternated back and forth between winning and losing weeks for the last couple months.

Digging deeper, the S&P 500 sectors were mostly positive. Communication Services was the lone holdout in negative territory while the other 10 were positive. Communication Services were impacted in part by the news that the DOJ would be forcing Google’s parent company, Alphabet, to sell off the Chrome web browser, due to antitrust concerns.

A handful of other companies also caught the markets’ attention with headlines related to earnings as the earnings season began to wind down. It was a tale of two companies as both Target and Walmart reported earnings within the Consumer Staples space. Target reported their biggest miss in two years, causing shares to drop sharply. Meanwhile, Walmart reported a beat in their earnings sending prices higher. This highlights how companies, even large and established ones, can have significantly different results within the same space.

Major Markets |

YTD as of 11/22/2024 | ||

| Nasdaq |  |

||

| Dow Jones Industrial |  |

||

| S&P 500 |  |

||

| MSCI World |  |

||

| MSCI EM |  |

||

| Russell 2000 |  |

||

| Bar US Agg Bnd |  |

||

|

|||

S&P Sectors |

|

|||||

| Comm. Services |  |

|||||

| Cons. Discretionary |  |

|||||

| Cons. Staples |  |

|||||

| Energy |  |

|||||

| Financials |  |

|||||

| Health Care |  |

|||||

| Industrials |  |

|||||

| Info. Technology |  |

|||||

| Materials |  |

|||||

| Real Estate |  |

|||||

| Utilities |  |

|||||

|

||||||

| Agent/Broker Dealer Use Only | ||||||

Small and Mid-cap companies did even better than Large Cap across the style boxes last week. This helped to recoup some of the underperformance for earlier this year.

The Economic Calendar was light last week with little directional change for market participants. Home Builder Confidence exceeded expectation while Housing Starts missed forecasts and Home Sales slightly beat estimates.

Finally, treasuries were effectively unchanged last week with only slight changes in most of the durations.

Concerned about inflation? Check out our Tips to Reduce Risks In Case of Recession.

| The S&P 500® Index is a capitalization index of 500 stock-designed to measure performance of the broad domestic economy through changes in the aggregate market value of stock representing all major industries. https://us.spindices.com/indices/equity/sp-500 The Dow Jones Industrial Average® (The Dow®), is a price-weighted measure of 30 U.S. blue-chip companies. The index covers all industries except transportation and utilities. https://us.spindices.com/indices/equity/dow-jones-industrial-average The NASDAQ Composite Index measures all NASDAQ domestic and international based common type stocks listed on The NASDAQ Stock Market. Today the NASDAQ Composite includes over 2,500 companies, more than most other stock market indexes. Because it is so broad-based, the Composite is one of the most widely followed and quoted major market indexes. https://indexes.nasdaqomx.com/Index/Overview/COMP The MSCI World Index, which is part of The Modern Index Strategy, is a broad global equity benchmark that represents large and mid-cap equity performance across 23 developed markets countries. It covers approximately 85% of the free float-adjusted market capitalization in each country and MSCI World benchmark does not offer exposure to emerging markets. The MSCI Emerging Markets (EM) Index is designed to represent the performance of large- and mid-cap securities in 24 Emerging Markets countries of the Americas, Europe, the Middle East, Africa and Asia. As of December 2017, it had more than 830 constituents and covered approximately 85% of the free float-adjusted market capitalization in each country. https://www.msci.com/ The S&P GSCI Crude Oil index provides investors with a reliable and publicly available benchmark for investment performance in the crude oil market. https://us.spindices.com/indices Companies in the S&P 500 Sector Indices are classified based on the Global Industry Classification Standard (GICS®). https://us.spindices.com/indices |