Weekly Market Commentary

Markets Rally as Earnings Roll In During Political Shifts

Posted on January 31, 2025

Markets Rally as Earnings Roll In During Political Shifts

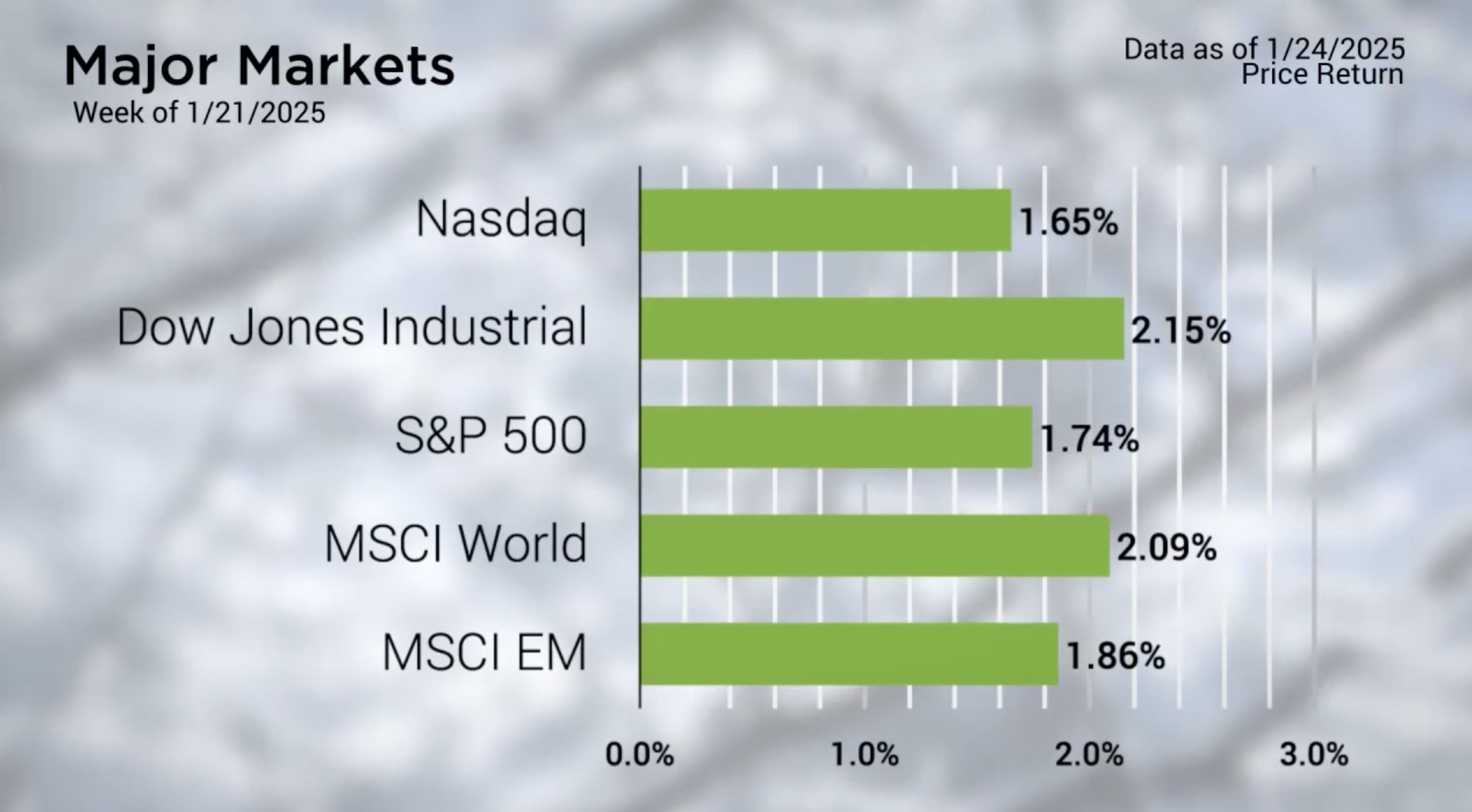

The major markets had a strong week, gaining across all five indices, despite the shortened holiday week. It kicked off with the Martin Luther King Jr. holiday, which also happened to overlap with President Trump’s inauguration. This made him only the second president in history to be sworn in for two non-consecutive terms.

Right after taking office, President Trump wasted no time, signing multiple executive orders and pardons within hours. One key move was declaring a national energy emergency . He also called into the World Economic Forum in Davos, urging Saudi Arabia and OPEC to lower oil prices.

Looking at the sectors, energy was the only one to close lower, possibly because of worries that an increase in oil supply could lower prices in the market along with the call to action by the OPEC nations.

Major Markets |

YTD as of 01/24/2025 | ||

| Nasdaq |  |

||

| Dow Jones Industrial |  |

||

| S&P 500 |  |

||

| MSCI World |  |

||

| MSCI EM |  |

||

| Russell 2000 |  |

||

| Bar US Agg Bnd |  |

||

|

|||

S&P Sectors |

|

|||||

| Comm. Services |  |

|||||

| Cons. Discretionary |  |

|||||

| Cons. Staples |  |

|||||

| Energy |  |

|||||

| Financials |  |

|||||

| Health Care |  |

|||||

| Industrials |  |

|||||

| Info. Technology |  |

|||||

| Materials |  |

|||||

| Real Estate |  |

|||||

| Utilities |  |

|||||

|

||||||

| Agent/Broker Dealer Use Only | ||||||

Despite the busy week in Washington, the rest of the market seemed to follow its usual course. The S&P 500 reached a new all-time high, closing at 6,118.71 on Thursday.

Earnings season really kicked off last week, with 323 companies reporting. Many of these are major players in the Dow Jones Industrial Average or the S&P 500. According to FactSet, earnings have been strong so far, with 80% of the 16% of companies in the S&P 500 that have reported beating earnings estimates.

This week, 371 more companies will release their earnings, along with a full set of economic data.

https://www.whitehouse.gov/presidential-actions/2025/01/declaring-a-national-energy-emergency

https://insight.factset.com/sp-500-earnings-season-update-january-24-2025

High earner? Learn how a backdoor Roth IRA can help maximize your retirement savings—even if you face income limits.

| The S&P 500® Index is a capitalization index of 500 stock-designed to measure performance of the broad domestic economy through changes in the aggregate market value of stock representing all major industries. https://us.spindices.com/indices/equity/sp-500 The Dow Jones Industrial Average® (The Dow®), is a price-weighted measure of 30 U.S. blue-chip companies. The index covers all industries except transportation and utilities. https://us.spindices.com/indices/equity/dow-jones-industrial-average The NASDAQ Composite Index measures all NASDAQ domestic and international based common type stocks listed on The NASDAQ Stock Market. Today the NASDAQ Composite includes over 2,500 companies, more than most other stock market indexes. Because it is so broad-based, the Composite is one of the most widely followed and quoted major market indexes. https://indexes.nasdaqomx.com/Index/Overview/COMP The MSCI World Index, which is part of The Modern Index Strategy, is a broad global equity benchmark that represents large and mid-cap equity performance across 23 developed markets countries. It covers approximately 85% of the free float-adjusted market capitalization in each country and MSCI World benchmark does not offer exposure to emerging markets. The MSCI Emerging Markets (EM) Index is designed to represent the performance of large- and mid-cap securities in 24 Emerging Markets countries of the Americas, Europe, the Middle East, Africa and Asia. As of December 2017, it had more than 830 constituents and covered approximately 85% of the free float-adjusted market capitalization in each country. https://www.msci.com/ The S&P GSCI Crude Oil index provides investors with a reliable and publicly available benchmark for investment performance in the crude oil market. https://us.spindices.com/indices Companies in the S&P 500 Sector Indices are classified based on the Global Industry Classification Standard (GICS®). https://us.spindices.com/indices |