Weekly Market Commentary

Markets Slide as 2025 Begins with Uncertainty

Posted on January 16, 2025

Markets Slide as 2025 Begins with Uncertainty

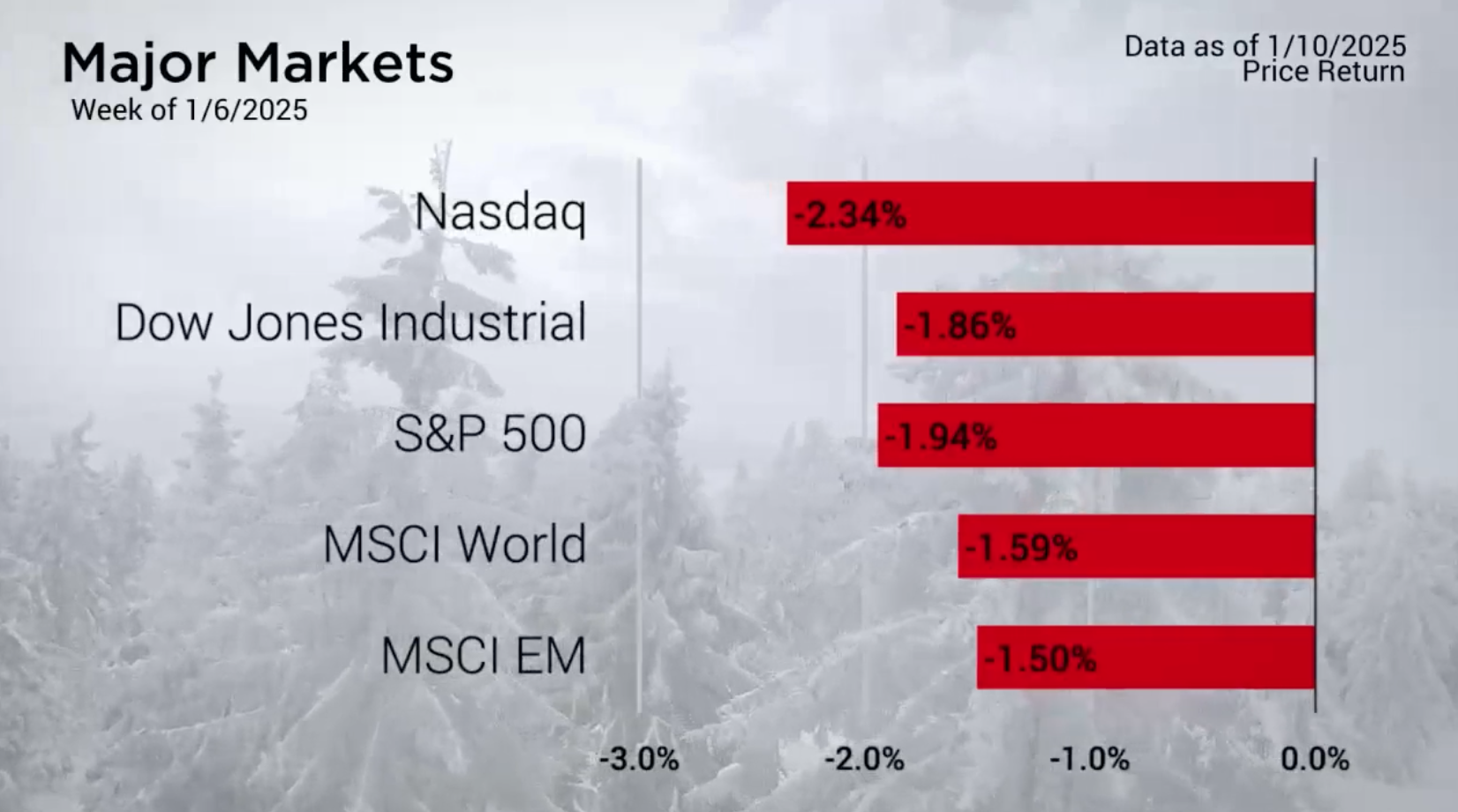

The new year got off to a rocky start, with markets taking a hit across the board during the first full week of 2025. The domestic market felt the brunt of it, as the Nasdaq dropped over 2%.

What stood out this week was how widespread the losses were. They weren’t confined to a single area or sector. Large-cap stocks were hit hardest in the growth segment, but even small-cap stocks performed worse overall, with small-cap value stocks falling more than small-cap growth stocks. Mid-cap stocks landed somewhere in the middle.

This time of year can be a bit of a lull for the markets. There’s not always a lot of economic news before earnings season kicks off. But 2025 is shaping up to be unique, not just because it’s a new year, but because of a big shift in political leadership. For only the second time in U.S. history, a former president is returning to office. President Trump and the Republican Party will control both the House and the Senate, solidified with the certification of election results on January 6th.

Even before officially taking office, President Trump’s comments on tariffs and other policies have raised eyebrows among market analysts. Many are concerned these moves could lead to higher inflation—or worse, stagflation.

Major Markets |

YTD as of 01/10/2025 | ||

| Nasdaq |  |

||

| Dow Jones Industrial |  |

||

| S&P 500 |  |

||

| MSCI World |  |

||

| MSCI EM |  |

||

| Russell 2000 |  |

||

| Bar US Agg Bnd |  |

||

|

|||

S&P Sectors |

|

|||||

| Comm. Services |  |

|||||

| Cons. Discretionary |  |

|||||

| Cons. Staples |  |

|||||

| Energy |  |

|||||

| Financials |  |

|||||

| Health Care |  |

|||||

| Industrials |  |

|||||

| Info. Technology |  |

|||||

| Materials |  |

|||||

| Real Estate |  |

|||||

| Utilities |  |

|||||

|

||||||

| Agent/Broker Dealer Use Only | ||||||

Adding to the uncertainty, the Federal Reserve released the minutes from their December meeting last week. Inflation was a key theme, despite the Fed cutting interest rates three times last year. They highlighted concerns about how trade and immigration policy changes could slow the fight against inflation, stating:

“the effects of potential changes in trade and immigration policy, suggested that the process could take longer than previously anticipated. Several observed that the disinflationary process may have stalled temporarily or noted the risk that it could. A couple of participants judged that positive sentiment in financial markets and momentum in economic activity could continue to put upward pressure on inflation. All participants judged that uncertainty about the scope, timing, and economic effects of potential changes in policies affecting foreign trade and immigration was elevated.”

In response, interest rates climbed last week, with the yield curve rising by as much as 19 basis points as markets braced for what’s ahead.

For now, though, everything remains speculative. The real test will come next week when the Trump Administration officially takes office and starts putting its policies into action.

https://www.cnn.com/2024/12/17/economy/trumps-tariffs-stagflation/index.html

https://www.federalreserve.gov/monetarypolicy/files/fomcminutes20241218.pdf

High earner? Learn how a backdoor Roth IRA can help maximize your retirement savings—even if you face income limits.

| The S&P 500® Index is a capitalization index of 500 stock-designed to measure performance of the broad domestic economy through changes in the aggregate market value of stock representing all major industries. https://us.spindices.com/indices/equity/sp-500 The Dow Jones Industrial Average® (The Dow®), is a price-weighted measure of 30 U.S. blue-chip companies. The index covers all industries except transportation and utilities. https://us.spindices.com/indices/equity/dow-jones-industrial-average The NASDAQ Composite Index measures all NASDAQ domestic and international based common type stocks listed on The NASDAQ Stock Market. Today the NASDAQ Composite includes over 2,500 companies, more than most other stock market indexes. Because it is so broad-based, the Composite is one of the most widely followed and quoted major market indexes. https://indexes.nasdaqomx.com/Index/Overview/COMP The MSCI World Index, which is part of The Modern Index Strategy, is a broad global equity benchmark that represents large and mid-cap equity performance across 23 developed markets countries. It covers approximately 85% of the free float-adjusted market capitalization in each country and MSCI World benchmark does not offer exposure to emerging markets. The MSCI Emerging Markets (EM) Index is designed to represent the performance of large- and mid-cap securities in 24 Emerging Markets countries of the Americas, Europe, the Middle East, Africa and Asia. As of December 2017, it had more than 830 constituents and covered approximately 85% of the free float-adjusted market capitalization in each country. https://www.msci.com/ The S&P GSCI Crude Oil index provides investors with a reliable and publicly available benchmark for investment performance in the crude oil market. https://us.spindices.com/indices Companies in the S&P 500 Sector Indices are classified based on the Global Industry Classification Standard (GICS®). https://us.spindices.com/indices |