Weekly Market Commentary

Markets Surge Amid Inauguration

Posted on January 24, 2025

Markets Surge Amid Inauguration

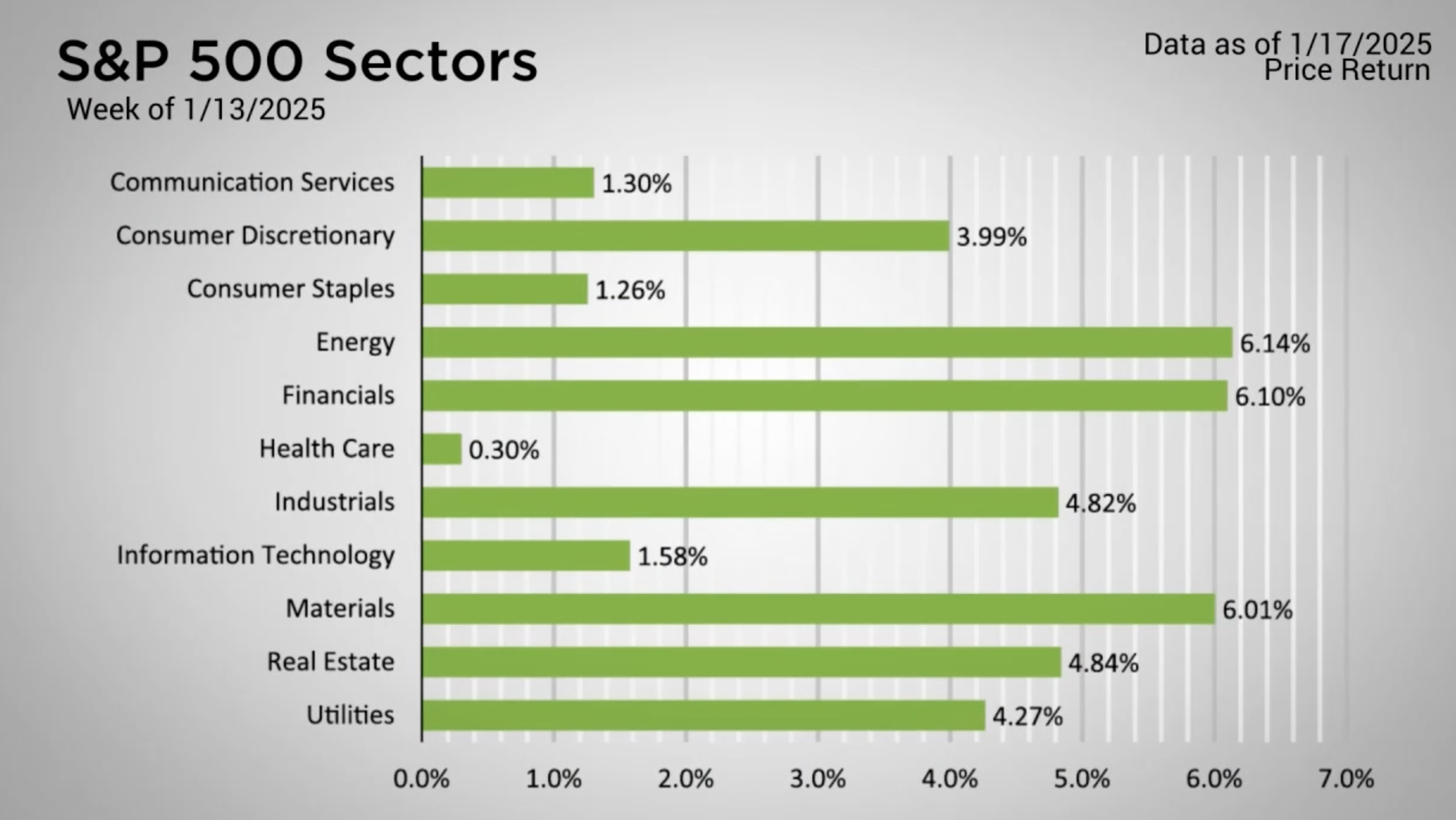

The Major Markets saw all green last week. For the S&P 500, this served as the best weekly gains since the week of November 8th. This has effectively bookended the period between Election Day last year and the week ahead of Inauguration Day.

This week was noteworthy of course for the Martin Luther King Jr. Federal Holiday along with the inauguration of President Trump as the 47th President of the United States. Last week, all eleven sectors managed to close higher, with Energy serving as the top performing segment. This area was highlighted specifically in Trump’s inauguration address in which he said:

“We will bring prices down, fill our strategic reserves up again, right to the top, and export American energy all over the world. We will be a rich nation again, and it is that liquid gold under our feet that will help to do it.”

Shortly after his inauguration, Trump signed an Executive Order declaring a National Energy Emergency. How this and other policy changes will impact the markets remains to be seen.

Shifting gears from politics, the Consumer Price Index (CPI) report released on Wednesday showed inflation running hotter than expected, with a monthly increase of 0.4% compared to the forecasted 0.3%. Inflation remains a major concern for the Federal Reserve, and as a result, the CME Group has adjusted its interest rate forecasts. As of Friday, the most likely scenario points to just one interest rate cut in 2025, with a smaller chance of an additional cut later in the year.

Major Markets |

YTD as of 01/17/2025 | ||

| Nasdaq |  |

||

| Dow Jones Industrial |  |

||

| S&P 500 |  |

||

| MSCI World |  |

||

| MSCI EM |  |

||

| Russell 2000 |  |

||

| Bar US Agg Bnd |  |

||

|

|||

S&P Sectors |

|

|||||

| Comm. Services |  |

|||||

| Cons. Discretionary |  |

|||||

| Cons. Staples |  |

|||||

| Energy |  |

|||||

| Financials |  |

|||||

| Health Care |  |

|||||

| Industrials |  |

|||||

| Info. Technology |  |

|||||

| Materials |  |

|||||

| Real Estate |  |

|||||

| Utilities |  |

|||||

|

||||||

| Agent/Broker Dealer Use Only | ||||||

Finally, last week marked the start of the Q4 earnings season. This week, over 300 companies are set to report, with earnings season reaching its peak at the end of February. All eyes will be on these reports, along with Washington, to provide further clues about the state of the economy and markets.

https://www.cnn.com/2025/01/20/politics/video/president-donald-trump-full-inaugural-address-digvid

https://www.whitehouse.gov/presidential-actions/2025/01/declaring-a-national-energy-emergency

High earner? Learn how a backdoor Roth IRA can help maximize your retirement savings—even if you face income limits.

| The S&P 500® Index is a capitalization index of 500 stock-designed to measure performance of the broad domestic economy through changes in the aggregate market value of stock representing all major industries. https://us.spindices.com/indices/equity/sp-500 The Dow Jones Industrial Average® (The Dow®), is a price-weighted measure of 30 U.S. blue-chip companies. The index covers all industries except transportation and utilities. https://us.spindices.com/indices/equity/dow-jones-industrial-average The NASDAQ Composite Index measures all NASDAQ domestic and international based common type stocks listed on The NASDAQ Stock Market. Today the NASDAQ Composite includes over 2,500 companies, more than most other stock market indexes. Because it is so broad-based, the Composite is one of the most widely followed and quoted major market indexes. https://indexes.nasdaqomx.com/Index/Overview/COMP The MSCI World Index, which is part of The Modern Index Strategy, is a broad global equity benchmark that represents large and mid-cap equity performance across 23 developed markets countries. It covers approximately 85% of the free float-adjusted market capitalization in each country and MSCI World benchmark does not offer exposure to emerging markets. The MSCI Emerging Markets (EM) Index is designed to represent the performance of large- and mid-cap securities in 24 Emerging Markets countries of the Americas, Europe, the Middle East, Africa and Asia. As of December 2017, it had more than 830 constituents and covered approximately 85% of the free float-adjusted market capitalization in each country. https://www.msci.com/ The S&P GSCI Crude Oil index provides investors with a reliable and publicly available benchmark for investment performance in the crude oil market. https://us.spindices.com/indices Companies in the S&P 500 Sector Indices are classified based on the Global Industry Classification Standard (GICS®). https://us.spindices.com/indices |