Weekly Market Commentary

NVIDIA’s Earnings Release

Posted on February 27, 2024

Larson Market Commentary

The President’s Day shortened trading week saw the Major Markets climb higher with the S&P 500 and Dow Jones Industrial Average logging new all-time highs.

The domestic market gains of the week were effectively rolled up into Thursday. Not only did Thursday mark the largest number of companies reporting their 1st quarter earnings results, they also included the results for one of the largest companies in the S&P 500, NVIDIA.

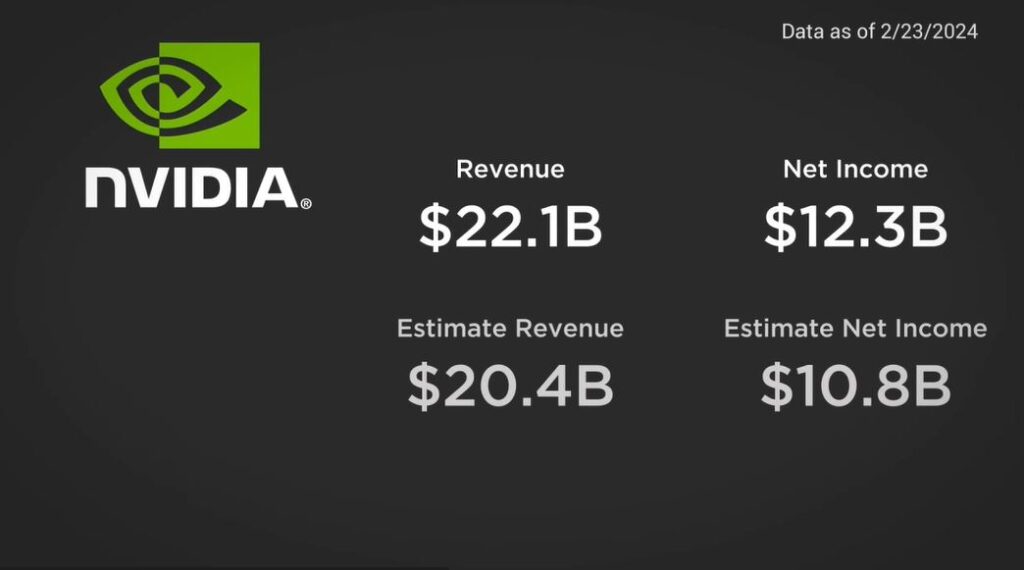

| Truthfully, NVIDIA released their earnings on Wednesday, however, it was after the market close, so the impact of the news wasn’t felt until the next trading day. The company beat both Revenue and Net Income estimates by about 20 percent and reported an earnings per share beat not far off from that percentage. The earnings beat caused the stock price to jump over 16 percent and consequently spurred the greater stock market higher. |

Major Markets |

YTD as of 02/23/2024 | ||

| Nasdaq |  |

||

| Dow Jones Industrial |  |

||

| S&P 500 |  |

||

| MSCI World |  |

||

| MSCI EM |  |

||

| Russell 2000 |  |

||

| Bar US Agg Bnd |  |

||

|

|||

S&P Sectors |

|

|||||

| Comm. Services |  |

|||||

| Cons. Discretionary |  |

|||||

| Cons. Staples |  |

|||||

| Energy |  |

|||||

| Financials |  |

|||||

| Health Care |  |

|||||

| Industrials |  |

|||||

| Info. Technology |  |

|||||

| Materials |  |

|||||

| Real Estate |  |

|||||

| Utilities |  |

|||||

|

||||||

| Agent/Broker Dealer Use Only | ||||||

The positive sentiment was widespread last week.

While NVIDIA did a lot to stimulate perceptions about the domestic market, the Information Technology sector was only the second-best performer behind Consumer Staples. The positive sentiment was widespread last week. In fact, all 11 sectors closed higher, and only two sectors had less than a percentage point gain for the week.

The one area of the market that fell short of the overall exuberance was small caps. The Small Cap Value corner of the style box saw the greatest pullback while the rest of the bottom boxes were underwater for the week.

What’s our Foundation up to?

Check out the latest happenings from the African Christian University Farm.

| The S&P 500® Index is a capitalization index of 500 stock-designed to measure performance of the broad domestic economy through changes in the aggregate market value of stock representing all major industries. https://us.spindices.com/indices/equity/sp-500 The Dow Jones Industrial Average® (The Dow®), is a price-weighted measure of 30 U.S. blue-chip companies. The index covers all industries except transportation and utilities. https://us.spindices.com/indices/equity/dow-jones-industrial-average The NASDAQ Composite Index measures all NASDAQ domestic and international based common type stocks listed on The NASDAQ Stock Market. Today the NASDAQ Composite includes over 2,500 companies, more than most other stock market indexes. Because it is so broad-based, the Composite is one of the most widely followed and quoted major market indexes. https://indexes.nasdaqomx.com/Index/Overview/COMP The MSCI World Index, which is part of The Modern Index Strategy, is a broad global equity benchmark that represents large and mid-cap equity performance across 23 developed markets countries. It covers approximately 85% of the free float-adjusted market capitalization in each country and MSCI World benchmark does not offer exposure to emerging markets. The MSCI Emerging Markets (EM) Index is designed to represent the performance of large- and mid-cap securities in 24 Emerging Markets countries of the Americas, Europe, the Middle East, Africa and Asia. As of December 2017, it had more than 830 constituents and covered approximately 85% of the free float-adjusted market capitalization in each country. https://www.msci.com/ The S&P GSCI Crude Oil index provides investors with a reliable and publicly available benchmark for investment performance in the crude oil market. https://us.spindices.com/indices Companies in the S&P 500 Sector Indices are classified based on the Global Industry Classification Standard (GICS®). https://us.spindices.com/indices |