What is a Qualified Opportunity Zone?

Introduced under the Tax Cuts and Jobs Act of 2017, an Opportunity Zone is an economically distressed area that is nominated by individual states and certified by the IRS. A complete list of QOZs is available on the US Department of Treasury’s website.

Economically distressed communities (>20% poverty rate), many of which have experienced a lack of investment for decades.

New investments in Qualified Opportunity Zones have been designated as eligible for preferential tax treatment as an incentive to spur economic growth and job creation in these underserved communities.

For a fund to qualify, it must hold at least 90% of its assets in Qualified Opportunity Zone property.

Key Benefits

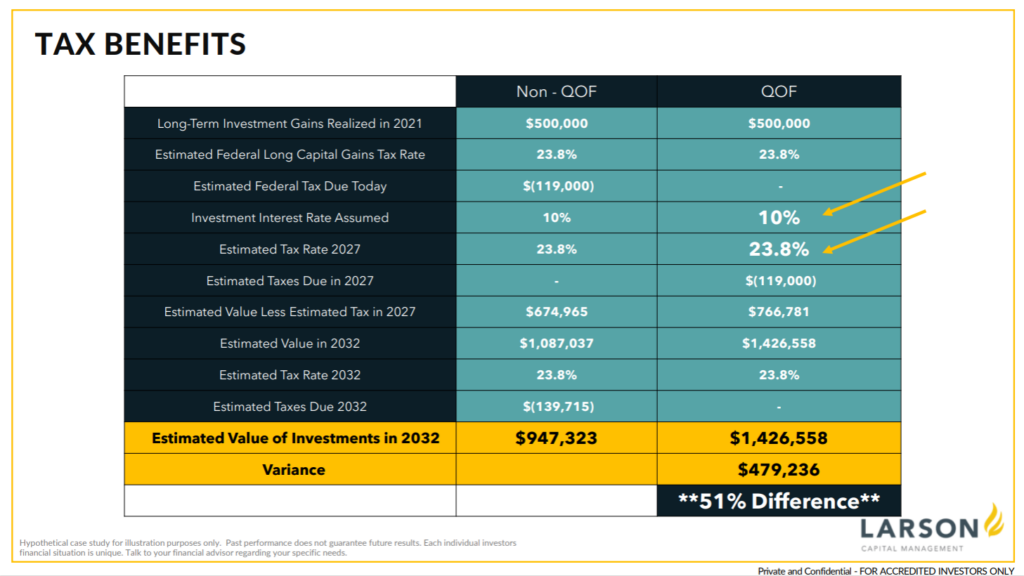

Tax Deferral

Defer your capital gains realized from a previous investment through the end of 2026 by reinvesting those capital gains into Larson’s LCOZ Fund

Tax Elimination

Pay zero taxes on capital gains the LCOZ generates by holding the investment for 10 or more years

While beneficial in a variety of ways, the Opportunity Zone program regulations can be somewhat complex so it’s important to Schedule a Visit with an Advisor to discuss the possible benefits and risks associated with investing in a QOF.