Weekly Market Commentary

Tech Tumbles: Nasdaq Falls as AI Disrupts Markets

Posted on February 7, 2025

Tech Tumbles: Nasdaq Falls as AI Disrupts Markets

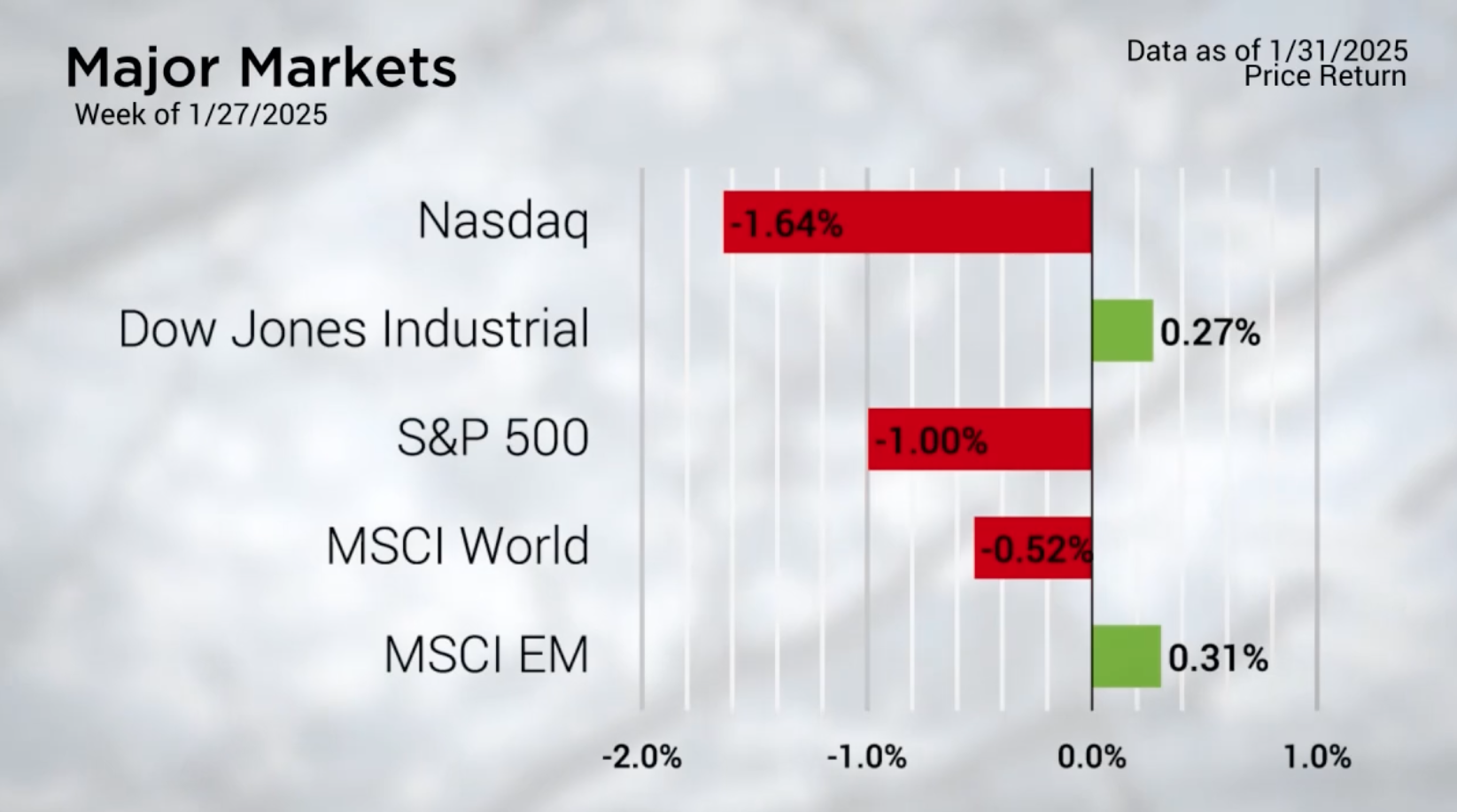

The major markets had mixed results last week, with the Nasdaq taking the biggest hit, down 1.64%. Looking closer at domestic markets, the biggest pullback came from the Information Technology sector. Since technology makes up nearly 60% of the Nasdaq, this drop had a big impact on the overall index. The main news driving the market was an announcement from China over the weekend about a new AI platform called DeepSeek. DeepSeek is designed to compete with AI models like OpenAI’s ChatGPT. What makes it stand out is that it was developed at a fraction of the cost—around $5.5 million , compared to OpenAI’s $100 million.

For many investors, the key question is whether DeepSeek can truly compete with other AI models, but at such a lower cost. If it can, it could change the way the tech industry operates, using far less processing power to drive the same results.

This news led to a sharp drop in NVIDIA stock on Monday, with the company’s shares falling 17%. While the stock did recover a bit on Tuesday, it still ended the week down around 16%. Since the S&P 500 is weighted by market capitalization, a big drop in a major stock like NVIDIA, which is the third largest company in the index, has a large impact on the overall market. As a result, the S&P 500 fell about 1.5% on Monday and set the tone for the rest of the week.

Major Markets |

YTD as of 01/31/2025 | ||

| Nasdaq |  |

||

| Dow Jones Industrial |  |

||

| S&P 500 |  |

||

| MSCI World |  |

||

| MSCI EM |  |

||

| Russell 2000 |  |

||

| Bar US Agg Bnd |  |

||

|

|||

S&P Sectors |

|

|||||

| Comm. Services |  |

|||||

| Cons. Discretionary |  |

|||||

| Cons. Staples |  |

|||||

| Energy |  |

|||||

| Financials |  |

|||||

| Health Care |  |

|||||

| Industrials |  |

|||||

| Info. Technology |  |

|||||

| Materials |  |

|||||

| Real Estate |  |

|||||

| Utilities |  |

|||||

|

||||||

| Agent/Broker Dealer Use Only | ||||||

Midweek, the Federal Open Market Committee (FOMC) held its first meeting of the year and decided to keep interest rates steady between 4.25% and 4.50%. While most people expected the pause in rate cuts, the Fed also removed a key part of its statement. Previously, they had said inflation was making progress toward their 2% target . The removal of this language suggested that the chance of rate cuts anytime soon has diminished. In fact, the Fed’s outlook now even suggests the possibility of a rate hike in 2026.

https://www.businessinsider.com/deepseek-number-one-app-apple-store-openai-chatgpt-2025-1 https://www.wired.com/story/openai-ceo-sam-altman-the-age-of-giant-ai-models-is-already-over/ https://www.federalreserve.gov/monetarypolicy/files/monetary20241218a1.pdf

High earner? Learn how a backdoor Roth IRA can help maximize your retirement savings—even if you face income limits.

| The S&P 500® Index is a capitalization index of 500 stock-designed to measure performance of the broad domestic economy through changes in the aggregate market value of stock representing all major industries. https://us.spindices.com/indices/equity/sp-500 The Dow Jones Industrial Average® (The Dow®), is a price-weighted measure of 30 U.S. blue-chip companies. The index covers all industries except transportation and utilities. https://us.spindices.com/indices/equity/dow-jones-industrial-average The NASDAQ Composite Index measures all NASDAQ domestic and international based common type stocks listed on The NASDAQ Stock Market. Today the NASDAQ Composite includes over 2,500 companies, more than most other stock market indexes. Because it is so broad-based, the Composite is one of the most widely followed and quoted major market indexes. https://indexes.nasdaqomx.com/Index/Overview/COMP The MSCI World Index, which is part of The Modern Index Strategy, is a broad global equity benchmark that represents large and mid-cap equity performance across 23 developed markets countries. It covers approximately 85% of the free float-adjusted market capitalization in each country and MSCI World benchmark does not offer exposure to emerging markets. The MSCI Emerging Markets (EM) Index is designed to represent the performance of large- and mid-cap securities in 24 Emerging Markets countries of the Americas, Europe, the Middle East, Africa and Asia. As of December 2017, it had more than 830 constituents and covered approximately 85% of the free float-adjusted market capitalization in each country. https://www.msci.com/ The S&P GSCI Crude Oil index provides investors with a reliable and publicly available benchmark for investment performance in the crude oil market. https://us.spindices.com/indices Companies in the S&P 500 Sector Indices are classified based on the Global Industry Classification Standard (GICS®). https://us.spindices.com/indices |